Banks asked Gibraltar-based STM Fidecs - a company that he used to own share in - to set up the limited company behind the Leave.EU campaign. They set up the company in July and transferred it to Banks in August. Using an agent to set up a company for you is standard practice and using one that you are familiar with and trust is common sense.

Leave.EU is registered in the UK and registered to pay tax in the UK. Banks clearly chose STM Fidecs as an agent to set up the company for him because he knows and trusts them, not because of their speciality in "maximising tax efficiency for high wealth individuals" and "structuring international groups". Leave.EU is neither a high wealth individual nor an international group and is registered in the UK so it's hard to see how the Guardian could infer any benefit for Leave.EU or Banks from having STM Fidecs set up the company.

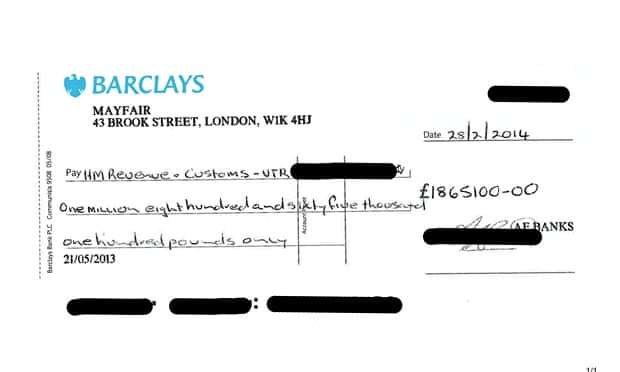

The Guardian tried to paint Banks as a shady tax dodger last year, prompting him to publish a copy of the cheque he sent to HMRC for his £1,865,100 personal tax bill and threaten legal action.

Of course, the Guardian aren't stupid enough to actually come out with an accusation of Banks or Leave.EU being involve in tax avoidance. They've just taken the facts, embellished them with unrelated and irrelevant information and left it to the read to put 2 and 2 together and come up with 5. This is something of a speciality for the Guardian whose readership is mostly too lazy or too stupid to separate facts from propaganda.

Something else that's a speciality for the Guardian is tax avoidance. Their in-depth knowledge of how companies like Starbucks or Amazon legally avoid paying tax doesn't come from research, they have first hand experience of tax dodging themselves.

The Guardian's offices are owned by an offshore subsidiary based in the Cayman Islands, the world's most notorious tax haven. This tax dodging company owns many of Guardian Media Group's investments and is shrouded in secrecy thanks to Cayman privacy laws. Last year the Guardian sold its controlling share of Autotrader to Apax Partners for £600m. How much tax did the Guardian pay on this £600m cash windfall? Nothing. They used the Substantial Shareholding Exemption scheme to avoid paying the £126m corporation tax bill on the profits.

In 2007, the Guardian purchased Emap for £1bn but managed to find a way of avoiding paying about £120m in stamp duty on the purchase. Meanwhile, in 2009 the Guardian made a pre-tax profit of £306.4m and ended up getting a tax rebate of £800k, leaving them with a corporation tax bill of just £800k or a measly 0.26% of their profits.

The Guardian are the ultimate hypocrites on taxation, bleating about tax dodgers and calling for boycotts of companies that don't pay their "fair share" of tax whilst funnelling their profits through companies in tax havens and dodging hundreds of millions of pounds of tax. One of the tax dodges the Guardian uses is moving money to Luxembourg where it pays 0.125% corporation tax through a registered tax avoidance scheme run by PriceWaterhouseCooper instead of the 20% rate it would pay if it wasn't part of a tax avoidance scheme or paid the corporation tax in the UK. This tax dodge is only possible because of EU double taxation regulations. No wonder the tax dodging Guardian is so keen to keep us in the EU.

wonkotsane is an author at Bloggers4UKIP.

wonkotsane is an author at Bloggers4UKIP.